- Home

- About

- News

- Tax Reform

- Ethics Reform

- Budget Reform

- Reformer’s Roundtable

- Contact Us

TAX REFORM IS WORKING!

Despite the fact that in recent years, the City of Philadelphia has REDUCED its tax rates, but INCREASED its tax revenues, some on City Council remain skeptical about the idea of adopting legislation to begin to phase out the job-killing Business Privilege Tax. The "proof" they seek is hard data on the number of jobs created by tax reductions, but (of course) changing complicated market dynamics is never so simple. Council members want to be able to point to a ribbon they cut or a building they funded to demonstrate concrete results, but the proof that tax reform is improving the city's competitiveness remains mired in economic mumbo-jumbo. So here is a brief walk through the evidence...

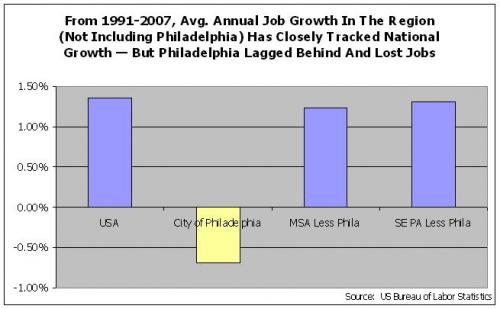

Economically, the city is just a small part of the national economy, so over the long haul, the city should aspire to grow when the nation grows. But, due in part to the city's high and unfair taxes, the city has lagged behind economically and when the nation grew, the city lost jobs even as the surrounding suburbs in the Metropolitan Statistical Area as a whole and in Southeastern Pennsylvania specifically gained jobs at the same pace as the nation.

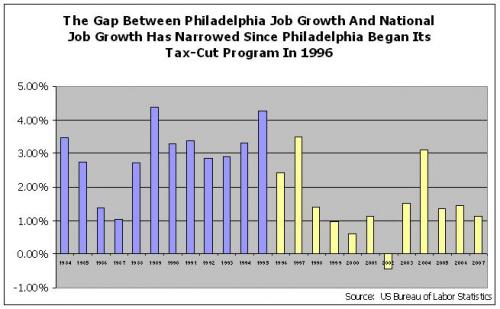

But, the good news is that since Philadelphia began its tax-reduction program in 1996, the gap between national job growth and city job growth has narrowed. In fact, in the 12 years before the city began its tax reductions, the gap between national job growth and city job growth was only less than 2.0% in two years, but since the tax reductions, the gap has been below 2.0% in nine of 12 years.

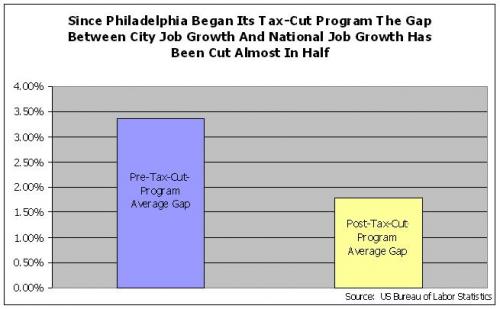

The city's modest tax reductions have slowly and steadily improved the city's competitiveness. Philadelphia's high and unfair taxes are still a major reason that the city has so much trouble attracting and retaining firms and families, but tax reform is clearly making a difference. The gap between national job growth and city job growth has been almost cut in half since the city began its tax reductions -- as we continue to improve the city's competitiveness, the city should continue to improve economically so when the nation is growing jobs, not only should the city lose fewer jobs, it should begin to demonstrate the steady growth over the long run seen in the region and the nation as a whole.

City Council is considering legislation (Bill 080022) to improve the city's competitiveness by eliminating the Gross Receipts Portion of the Job-Killing Business Privilege Tax and initiating the first-ever cuts to the Net Income Portion of the tax to help Philadelphia grow jobs, attract businesses, and retain employers. If we were to make Philadelphia taxes more fair and less burdensome, we could improve efforts to attract and retain jobs and neighbors.