Today, Real Estate Taxation in Philadelphia is unfair, uncertain, confusing -- and ILLEGAL. But positive policies can improve the system and make the transition in the most effective and painless manner possible. Philadelphia Forward has created an interactive resource using example city homes to give citizens and policy makers a resource to evaluate how proposed the pending full-value reassessment and other will affect city properties.

Why Does Philadelphia Need Full-Value Reassessment? -- Today, Real Estate Taxation in Philadelphia is unfair — Inaccurate assessment creates a situation where similar properties do not have similar tax bills, and where not all properties pay taxes based on the same percentage of property sale price.

The average city home is assessed at only approximately 32 percent of its potential sale value.

Many (often higher-price properties) are assessed lower while many (often lower-price properties) are assessed higher than potential resale value — many property owners are not paying their fair share, while others pay too much.

Two homes sold in 2007 for dramatically DIFFERENT amounts…a house in Southwest Center City at 23XX Saint Albans Street sold for $480,000; a Northeast Philadelphia house at 33XX Holme Avenue sold for $88,500. Look which home has a higher tax bill -- the home that sold for $88,500 has a $1,494 tax bill while the home that sold for $480,000 only pays $1,311.

These homes sold in 2007 the same amount, but all pay dramatically DIFFERENT tax bills…even after the 2008 reassessment. | 2007 PRICE | STREET ADDRESS | CITY NEIGHBORHOOD | BRT MARKET VALUE | 2008 TAX BILL |

| $250,000 | 17XX Annin | South Phila. | $6,400 | $169.25 |

| $250,000 | 21XX Webster | CC/Fairmount | $15,500 | $409.89 |

| $250,000 | 10XX Tasker | South Phila. | $35,000 | $925.57 |

| $250,000 | 12XX Crease | Kensington | $36,600 | $967.88 |

| $250,000 | 31XX DRAPER | Upper NE Phila. | $88,400 | $2,337.72 |

| $250,000 | 18XX Napfle | Lower NE Phila. | $87,700 | $2,319.21 |

| $250,000 | 5XX Pelham | NW Phila. | $113,800 | $3,009.42 |

| $250,000 | 67XX N 06th | North Phila. | $125,000 | $3,305.60 |

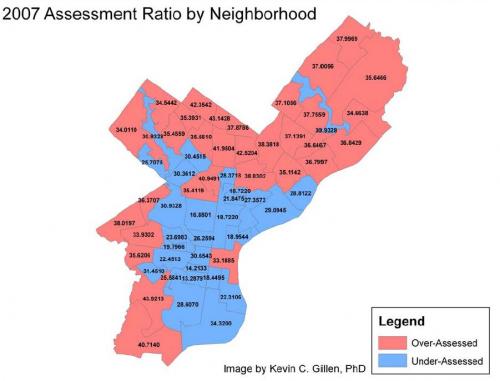

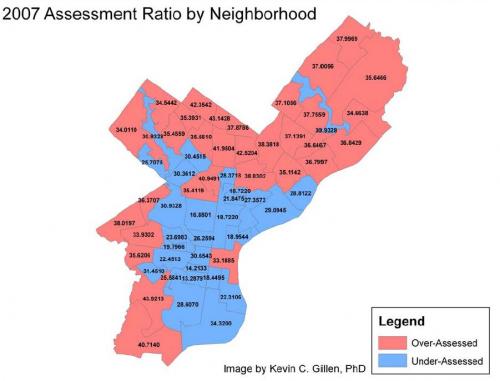

Examining how assessment unfairness affects the tax bills Philadelphians pay, it is clear that some neighborhoods are OVER-taxed while other neighborhoods are UNDER-taxed. On average, homeowners in neighborhoods shaded blue have a lower effective tax rate while homeowners in neighborhoods shaded red have a higher effective tax rate (32 is average). (Source Kevin Gillen, PhD)

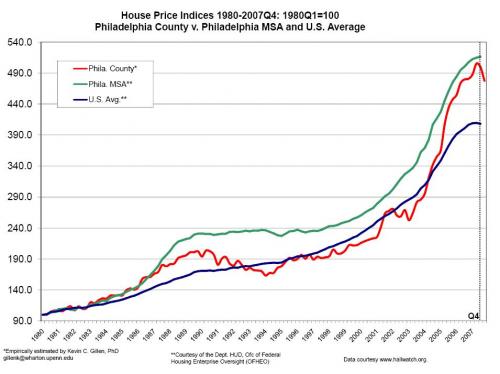

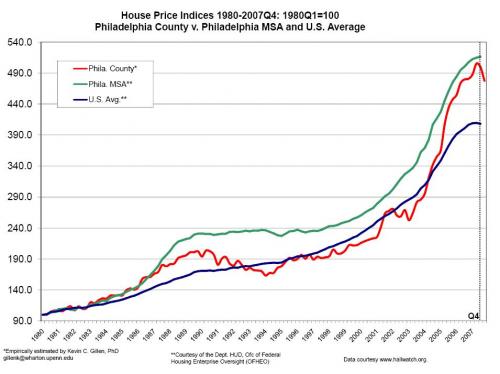

Real Estate Taxes in Philadelphia are also unpredictable. Assessment inaccuracies distort the real estate market and increase the volatility of Real Estate Tax revenue streams.

Tax bills that are higher or lower than they should be (because the market value for tax purposes is different from the potential sale price) affect property values, since buyers are willing to pay more for a low-tax property and less for a high-tax property.

Homeowners and investors live with uncertainty in terms of potential future dramatic changes in tax burden that would result from changes in the system.

The home of a well-known Philadelphia politician is on the market for $6 million, but valued for tax purposes at $250,000 and has a tax bill of $6,611 today. What will its tax bill be next year? Will it be $158,669, which would be its tax bill if its Market Value is $6 million? Or something else? If it is something else, how is it determined?

City home values DOUBLED since 2002, but assessments remained largely unchanged. In 2007, the city finally increased the values of more than 400,000 homes in a year when values decreased.

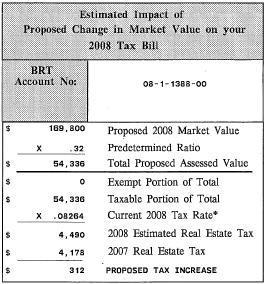

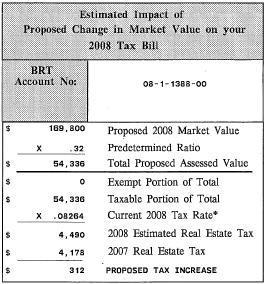

Finally, Real Estate Taxation in Philadelphia is confusing. Fractional assessments and technical jargon create unnecessary confusion.

The terms “market value” and “assessed value” sound alike, but they are very different. The relationship between “market value,” “assessed value,” and tax bills is often unclear to taxpayers.

Taxes are applied to only a fraction — 32% — of market value. The fact that the Board of Revision of Taxes sets property values while City Council and the Mayor set tax rates further complicates the situation.

Market Value? Predetermined Ratio? Assessed Value? Why is it so hard to tell the tax bill?

Most of all, real estate taxation is illegal. The BRT explains the definition of "Market Value" on its web site — "The most probable price (in terms of money) which a property should bring in a competitive and open market under all conditions requisite to a fair sale, the buyer and seller each acting prudently and knowledgeably, and assuming the price is not affected by undue stimulus." The Pennsylvania Constitution demands that "all taxes shall be uniform, upon the same class of subjects, within the territorial limits of the authority levying the tax." If, by law, all properties are to be assessed uniformly, then all properties should share the same basic relationship between their current potential resale value and their "Market Value" for tax purposes. But that is not the case in Philadelphia today. Therefore, the city is in comprehensive violation of uniformity and the most-recent assessments do not correct the problems. The assessment lacks uniformity with other properties within the taxing jurisdiction and is therefore illegal, improper, and unjust.

How Will Full-Value Reassessment Change Real Estate Tax Bills? -- The city’s property assessment agency, the Board of Revision of Taxes (BRT), announced it would end fractional assessments and complete a citywide reassessment to establish accurate values for all properties. Because the Board of Revision of Taxes only determines property values — City Council and the Mayor set tax rates and establish tax policy — unless other changes are made, a BRT revaluation will dramatically increase tax bills for city property owners.

oHow Can Policies Proposed By The Tax Reform Commission Make The Transition To A Fair System Less Painful? -- We must make Real Estate Taxation more fair. Maintaining the status quo is nothing short of maintaining a flawed system that forces some to pay too much while allowing others to pay too little as part of an overall system that skews the city’s real estate market. Policy options exist to make the transition to more fair system less painful.

First, reduce the tax rate to create a “revenue neutral” change. The proposed changes to the Real Estate Taxation system are not intended to generate additional revenue for the city, but eliminating fractional assessment will increase the value of city properties for tax purposes. By reducing the tax RATE, City Council and the Mayor can generate the money the city currently counts on to fund service-delivery efforts, while reducing the “shock to the system” caused by the reassessment. This “revenue-neutral” change would REDUCE tax burdens for properties that are currently over-assessed, but it would INCREASE tax burdens (in some cases substantially) for properties that are dramatically under-assessed.

Second, use a Real Estate Tax relief “buffering” system to prevent dramatic increases in a property’s tax bill. Any dramatic shift in tax policy that is implemented in a single year may have dramatic effects. By using a Real Estate Tax relief program to “buffer” the increases, city officials can phase in a fair system of Real Estate without creating unreasonable spikes in tax burdens. Buffering the assessment changes (applying a new “revenue-neutral” tax rate to an average of the current year’s assessment plus the prior two years’ assessments) will implement a system of rolling averages so historically under-assessed properties will not have such dramatic single-year increases in tax bills. Owners of historically over-assessed properties would not have as dramatic single-year decreases in their tax burdens. Third, tax buildings less and land more to reduce burdens for homeowners, while encouraging development and discouraging speculation (by making it expensive to hold vacant land and underutilized property). Because most homeowners own structures that are worth considerably more than the land upon which they sit, a decrease in taxes on buildings and an increase in taxes on land will reduce most tax burdens. By implementing Land-Value Taxation in a way to be “revenue-neutral” for the city, officials can encourage development and discourage speculation while reducing taxes for homeowners. Implementing Land-Value Taxation consistent with the Tax Reform Commission’s recommendation would reduce tax burdens for 80% of Philadelphia homeowners. Owners of properties where land represents a significant portion of the overall property value (more than 22.5%) would see their tax burdens increase marginally.

By combining the policies, the city can create an equitable and transparent Real Estate Tax System that can be implemented in the most effective and painless manner possible

A tax-rate decrease to ensure that the reassessments are revenue-neutral for the city will create a reasonable basis for the changes.

Using a Real Estate Tax relief program to "buffer" changes in assessed values will eliminate the most dramatic one-year changes in tax burden.

Land-Value Taxation will reduce tax burdens for most homeowners as it encourages development and discourages speculation.

How Can Policies Protect Vulnerable Homeowners Who Might Still See Their Tax Bills Increase, But Who Cannot Afford To Pay Higher Taxes? -- To ensure that Philadelphians are never forced to sell their homes to pay their Real Estate Tax bills, the city can implement additional policies to help vulnerable homeowners: Create Real Estate Tax deferments so vulnerable homeowners can live in their homes today and pay their tax burden in the future when they sell their homes.

Establish a Taxpayers’ Advocate to educate about Real Estate Taxation and help residents appeal unreasonable assessments.

Allow taxpayers to pay Real Estate Tax bills in quarterly payments so homeowners can spread payments throughout the year. (As a bonus, this measure would save the city and the school district millions in avoided borrowing costs.)

Apply tax payments to the current year’s tax liability so delinquent taxpayers making tax payments can qualify for state assistance.

Advocate for increased property tax relief from the Commonwealth of Pennsylvania: a state circuit-breaker property tax relief program could hold down Real Estate Tax increases for those on fixed incomes; state-funded low-income property tax relief programs could be expanded for truly needy taxpayers.

What Policies Should We Avoid If We Want To Fix The Problems? -- Policy makers must beware: other policies presented to address these issues could do more harm than good.

For example, if assessment increases are capped at 5% and two homes worth $100,000 today increase in value at different rates (one at 5% per year and one at 20% per year), after five years the owner of the first house will be paying taxes based on an assessment of 100% of potential sale value but the owner of the second will be paying taxes based on an assessment of only 51% of sale value.

| | House Increasing in Value at 5% Per Year | House Increasing in Value at 20% Per Year |

Year | Potential Sale Value | City-Determined Assessed Value (Assessment Capped at 5% Increase Per Year) | Ratio of City-Determined Assessed Value To Potential Sale Value | Potential Sale Value | City-Determined Assessed Value (Assessment Capped at 5% Increase Per Year) | Ratio of City-Determined Assessed Value To Potential Sale Value |

Today | $100,000 | $100,000 | 100% | $100,000 | $100,000 | 100% |

Year 1 | $105,000 | $105,000 | 100% | $120,000 | $105,000 | 88% |

Year 2 | $110,250 | $110,250 | 100% | $144,000 | $110,250 | 77% |

Year 3 | $115,762 | $115,762 | 100% | $172,800 | $115,762 | 67% |

Year 4 | $121,550 | $121,550 | 100% | $207,360 | $121,550 | 59% |

Year 5 | $127,628 | $127,628 | 100% | $248,832 | $127,628 | 51% |

For more information:

Explore the impact of citywide real estate reassessment

Explore the impact of citywide real estate reassessment Play our fun, interactive Tax Reform Challenge game

Play our fun, interactive Tax Reform Challenge game Click the movie to hear real people speak out for real tax reform.

Click the movie to hear real people speak out for real tax reform.