- Home

- About

- News

- Tax Reform

- Ethics Reform

- Budget Reform

- Reformer’s Roundtable

- Contact Us

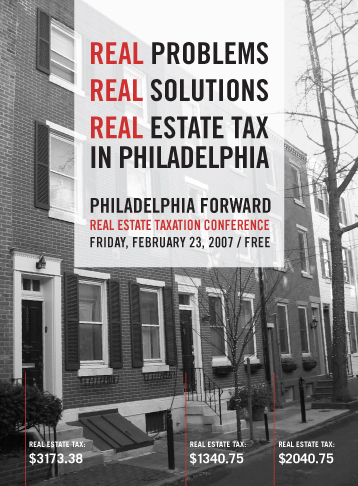

Virtual February 23rd Real Estate Taxation Conference

REAL Problems * REAL Solutions * Real Estate Tax In Philadelphia

Friday, February 23, 2007, 9:00 a.m. – 3:30 p.m.

Temple University Student Center, 13th & Montgomery Avenue

* VIRTUAL CONFERENCE *

Sponsored by:

![]()

What is wrong with this picture? Philadelphia Forward Executive Director Brett Mandel illustrates the problem: in Philadelphia similar properties pay different Real Estate Tax Bills. |

This problem can be fixed. Wellesley College Professor Karl Case tells how Boston made the transformation from a broken system to fair system of real estate taxation. |

About 200 people participated in the conference throughout the day. Attendees included elected officials, candidates, members of the media, and citizens from neighborhoods across the city. |

Dave Brunori from State Tax Notes explains that while homeowners often complain about taxes on real estate, implemented correctly, a Real Estate Tax is an appropriate tax for local jurisdictions. |

Conference participants were not shy about asking their questions to ensure that they understood the issues. Thekla Scott expresses her concerns about how taxes affect community residents. |

Attendees used web resources to see how proposed changes to the Real Estate Tax system could affect their tax bills. Click Here to use Philadelphia Forward's Real Estate Tax Calculator. |

Brett Mandel chaired the Tax Reform Commission's Real Estate Tax Working Group. It's recommendations called for making real estate taxation fair and for protecting vulnerable homeowners. |

Wharton's Kevin Gillen's showed that some city homeowners are undertaxed and some are overtaxed. His updated research confirms that the problem has gotten much worse in recent years. |

Over lunch, Wharton's Robert Inman explained the economics of local taxation and suggested that we avoid taxing businesses and commuters and concentrate Real Estate Taxes on the value of land. |

Board of Revision of Taxes chair David Glancey explained how full-value reassessment will set proper home values; elected officials would have to lower tax rates so the city won't see a windfall. |

City Controller Alan Butkovitz expressed his concerns that the Mayor and City Council would not reduce taxes and that full-value reassessment would then dramatically increase tax bills. |

Philadelphia Real Estate Tax law authority Joseph Bright warned that assessing at full value is the law. If we do not set fair and accurate values, the courts will force us to do so. |

The final panel of presenters addressed how Philadelphia can protect vulnerable homeowners and ensure that no Philadelphians will be forced out of their homes because of high taxes. It was a lively way to conclude the day and attendees asked probing questions to ensure that panelists answered their concerns. |

Mark Haveman from the Minnesota Taxpayers Association warned that assessment caps and tax freezes caps can make the tax structure even more unfair; Harrisburg Mayor Stephen Reed said that taxing land more and buildings less will help spur growth, but also lower tax bills for city homeowners. |

Building Industy Assn. Pres. Bill Reddish told that abatements have increased city tax revenues; Bert Waisanen from the Nat'l Conf. of St. Legislatures told of policies to hold down low-income residents' tax bills; Hallwatch's Ed Goppelt called for the city to collect the $500 million it is owed in back taxes. |

Conference Proceedings

REAL Problems

REAL Solutions

REAL Estate Tax In Philadelphia

Friday, February 23, 2007

Temple University

9:00-9:15 — Welcome/Introduction

Bishop Ethan Thornton, Philadelphia Forward

Brett Mandel, Executive Director, Philadelphia Forward

9:15-10:00 — A Successful Transition From Unfairness To Fairness — The Massachusetts Experience

Ahmeenah Young, Philadelphia Forward — Introduction

Karl Case, Professor of Economics, Wellesley College

10:00-10:45 — Real Estate Taxation: What's right and what's wrong about taxing real estate?

John Chin, Philadelphia Forward — Introduction

Dave Brunori, Contributing Editor, State Tax Notes

10:45-11:00 — BREAK 11:00-11:45 — Problems in Philadelphia With Real Estate Taxation: Tax Reform Commission research

Colleen Puckett, Philadelphia Forward — Introduction

Brett Mandel, Executive Director, Philadelphia Forward

Kevin Gillen, Wharton Research Fellow

11:45-12:45 — LUNCH — The Real Estate Tax in Context: Philadelphia’s Fiscal Situation

David Thornburgh, Philadelphia Forward — Introduction

Bob Inman, Professor of Finance, Wharton School of Business

12:45-1:30 — The Board of Revision of Taxes And The "Full-Value" Project

Diane Lucidi, Philadelphia Forward — Introduction

Dave Glancey, Chair, Philadelphia Board of Revision of Taxes

The Honorable Alan Butkovitz, City Controller, City of Philadelphia

Joseph Bright, Partner Wolf, Block, Schorr and Solis-Cohen LLP

1:30-1:45 — BREAK

1:45-2:45 — Help For The Homeowner — Real Estate Tax Relief Measures

Graham Finney, Philadelphia Forward — Introduction

Dave Brunori, Contributing Editor, State Tax Notes

· Prop 13/Caps/Freezes — Mark Haveman, Minnesota Taxpayers Association

· Land-Value Taxation — The Honorable Stephen R. Reed, Mayor, City of Harrisburg, PA

· Protecting Vulnerable Homeowners — Bert Waisanen, National Conf. of State Legislatures

· Tax Abatements In Philadelphia — William Reddish, President, Building Industry Assn. of Phila.

· Tax Delinquency in Philadelphia — Edmund Goppelt, Hallwatch.org

2:45-3:30 — Interactive Discussion: Creating A Fair And Understandable System of Real EstateTaxation…What You Can Do?

Dave Brunori, Contributing Editor, State Tax Notes

Brett Mandel, Executive Director, Philadelphia Forward

All Conference Participants